Blog

Find Out What’s Trending in the Transfer Pricing World

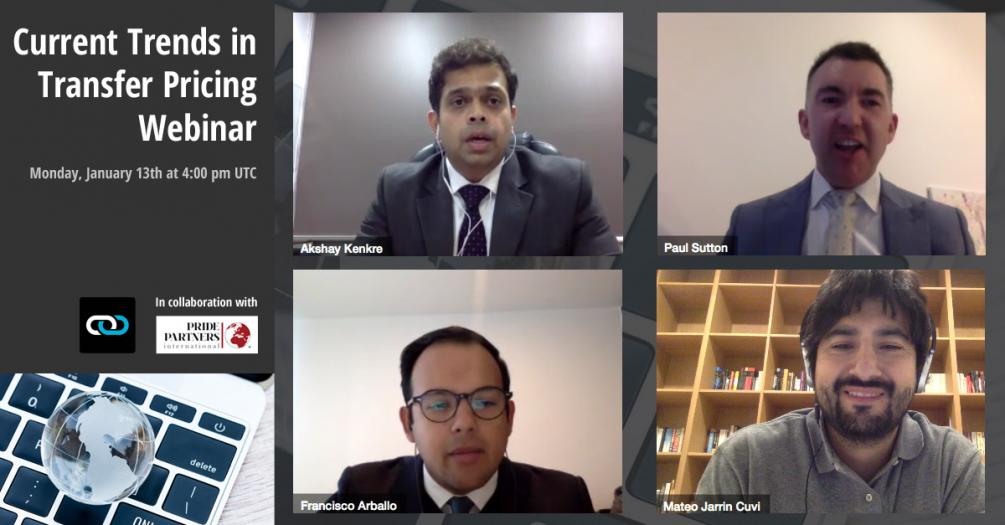

Did you happen to miss our first webinar of 2020 on what's currently trending in the wonderful world of transfer pricing?

Here's your chance to find out, as our panelists from the UK, Mexico and India caught us up on the latest news regarding TP and all of its associated acts.

A huge thank you to our co-organizer, Pride Partners International, and our panelists, Francisco Arballo, Senior Manager of Transfer Pricing, EFE Consulting Group Latin America, Mexico; Paul Sutton, Co-Founder, LCN Legal, United Kingdom, and; Akshay Kenkre, Founder, TransPrice Tax Advisors LLP, India, for answering our questions.

Here are some of the event's main highlights!

How important are legal agreements in practice? What trends are you seeing globally and locally?

Paul Sutton: "In terms of the impacts of legal agreements, one fundamental point that I think has affected the way that people look at transfer pricing and tax compliance in general is just the need for substance and the recognition that legal substance and legal reality is a key part of the implementation of transfer pricing alongside operational implementation. I think one of the global trends amongst tax administrations, taxpayers and tax advisors is really about the leveling up of standards. So there's a lot coming down the wire from the OECD to look forward to and a lot of national developments. But the reality is a lot of corporates and organizations are still struggling to comply with BEPS and to genuinely achieve the standards of the OECD's transfer pricing guidelines."

Paul Sutton: "In terms of the impacts of legal agreements, one fundamental point that I think has affected the way that people look at transfer pricing and tax compliance in general is just the need for substance and the recognition that legal substance and legal reality is a key part of the implementation of transfer pricing alongside operational implementation. I think one of the global trends amongst tax administrations, taxpayers and tax advisors is really about the leveling up of standards. So there's a lot coming down the wire from the OECD to look forward to and a lot of national developments. But the reality is a lot of corporates and organizations are still struggling to comply with BEPS and to genuinely achieve the standards of the OECD's transfer pricing guidelines."

How has transfer pricing as a law developed in your jurisdiction or country? What can be the learnings from transfer pricing implementation in your country?

Francisco Arballo: "In Mexico we've had transfer pricing regulations for about 24 years now. At the beginning, it was focused on international and domestic transactions between related parties. We have had an informative disclosure in place since the beginning of the legislation. The transfer pricing audits have been a learning process, a learning curve for both the taxpayers and tax administrations. We've had some major cases of transfer pricing adjustments to large multinational groups. In 2014, with Peña Nieto's tax reform, Mexico incorporated the three levels of documentation regarding the Action 13 of the BEPS Action Plan, which obligated taxpayers to present local, master and country-by-country reports. Hence, Mexico has always been in the forefront of adopting OECD recommendations along with Argentina when talking about Latin American countries that are frontrunners in implementing transfer pricing regulations."

Francisco Arballo: "In Mexico we've had transfer pricing regulations for about 24 years now. At the beginning, it was focused on international and domestic transactions between related parties. We have had an informative disclosure in place since the beginning of the legislation. The transfer pricing audits have been a learning process, a learning curve for both the taxpayers and tax administrations. We've had some major cases of transfer pricing adjustments to large multinational groups. In 2014, with Peña Nieto's tax reform, Mexico incorporated the three levels of documentation regarding the Action 13 of the BEPS Action Plan, which obligated taxpayers to present local, master and country-by-country reports. Hence, Mexico has always been in the forefront of adopting OECD recommendations along with Argentina when talking about Latin American countries that are frontrunners in implementing transfer pricing regulations."

How is technology being used to better comply with transfer pricing regulations?

![]() Akshay Kenkre: "India always remains a technology hub for the world, developing technology for the entire globe and transfer pricing is nowhere behind. If you look at the compliance part of transfer pricing, India is a country that has something called transfer pricing audits. I think most of the new countries that are implementing transfer pricing are now having transfer pricing audits. But there is this onus, which is placed on a chartered accountant to review all the transactions of the taxpayer and ultimately report it. Everything here is e-filed, most of the documents that are maintained by the taxpayer are e-filed documents, and you don't really need to maintain hard copies of them. Technology is also used in preparation of these transfer pricing documents by the taxpayer. Even if you look at the Master files and the CBC reporting, there are appropriate forms, which need to just be uploaded. Even if you talk of three presentations at the tax office, we are implementing something that is called a faceless assessment. So the taxpayer and the tax authorities won't know really whom they are interacting with. So everything happens through an exchange of mails or uploading of certain data through a central processing and transfer pricing is not behind there also. We have already started doing e-assessments this particular year. Whenever you talk of even tax appeals, these are also e-filed; at least appeals need to go to the court and be really attended for, but otherwise it's all used technology-based."

Akshay Kenkre: "India always remains a technology hub for the world, developing technology for the entire globe and transfer pricing is nowhere behind. If you look at the compliance part of transfer pricing, India is a country that has something called transfer pricing audits. I think most of the new countries that are implementing transfer pricing are now having transfer pricing audits. But there is this onus, which is placed on a chartered accountant to review all the transactions of the taxpayer and ultimately report it. Everything here is e-filed, most of the documents that are maintained by the taxpayer are e-filed documents, and you don't really need to maintain hard copies of them. Technology is also used in preparation of these transfer pricing documents by the taxpayer. Even if you look at the Master files and the CBC reporting, there are appropriate forms, which need to just be uploaded. Even if you talk of three presentations at the tax office, we are implementing something that is called a faceless assessment. So the taxpayer and the tax authorities won't know really whom they are interacting with. So everything happens through an exchange of mails or uploading of certain data through a central processing and transfer pricing is not behind there also. We have already started doing e-assessments this particular year. Whenever you talk of even tax appeals, these are also e-filed; at least appeals need to go to the court and be really attended for, but otherwise it's all used technology-based."

Happy reading!