Blog

2015 Financial Secrecy Index: Tax Justice Network Speaks Out!

In what has become a biannual event, Tax Justice Network released earlier this week the results of its 2015 Financial Secrecy Index, an in-depth analysis of the levels of transparency and offshore financial activities in jurisdictions throughout the globe.

According to their website, one of the goals of this index is to dismantle the myth that the world’s most important tax havens are remote tropical paradises chockfull of pristine mansions, catamarans, palm trees and endless summers. Instead, they say, “Rich OECD member countries and their satellites are the main recipients of or conduits for these illicit flows.”

This fact, of course, poses major problems in alleviating capital flight, tax evasion and financial secrecy. When the largest and most important economies in the world are also the main culprits behind these illicit behaviors, it is politically difficult—if not impossible—to put a stop to them.

Despite these difficulties, Tax Justice Network has seen improvements in this year’s rankings. The organization believes the world is currently witnessing a historic moment with governments, the media and civil society paying greater attention to financial secrecy and pushing for remedies to tax evasion and all of its complicit activities.

Lizz Nelson, a Director at Tax Justice Network, says, ““None of the reforms we’ve seen would have taken place without pressure from civil society and the streets. G7 and G20 leaders will do nothing unless pushed from below. So it’s essential to keep up the pressure, especially on matters such as implementing public disclosure of company ownership and, crucially, of trusts.”

In this regard, the G20 and OECD, for example, have agreed on a system to facilitate the automatic exchange of information to crack down on evaders, while the European Union has gone after anonymous companies by setting up an open and central register of beneficial owners.

However, there is still plenty of work to be done, and it all starts, according to the organization, by “identifying as accurately as possible the jurisdictions that make it their business to provide offshore secrecy.”

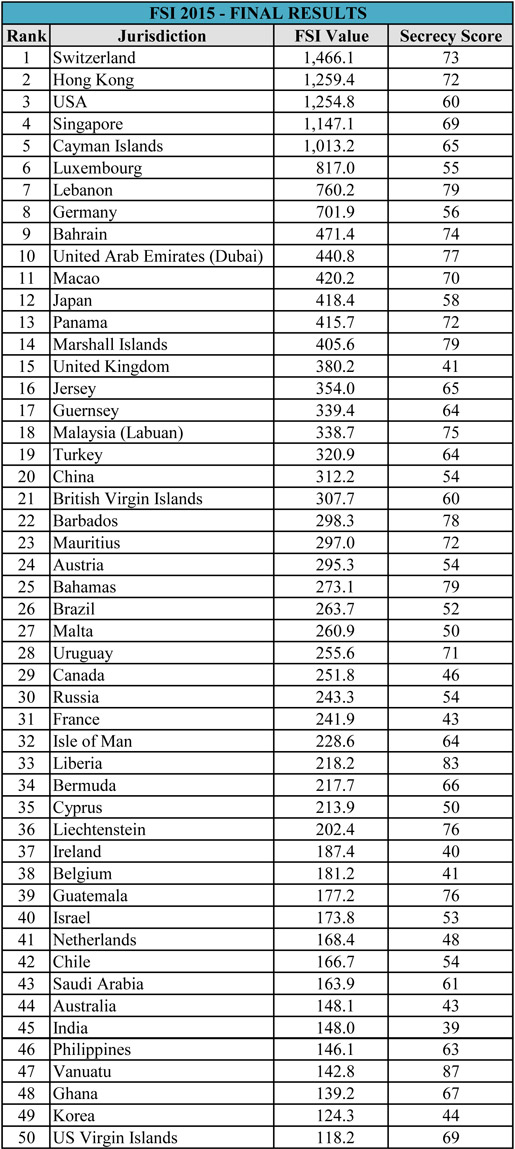

2015 Financial Secrecy Rankings – The Top 50

Here’s a table of the top 50 jurisdictions in this year’s rankings with Switzerland (once again) topping the list.

Like clockwork, the Swiss come in first thanks to its tough bank secrecy laws and push to build “market share in some of the world’s more vulnerable and badly governed developing countries, which will therefore continue to suffer Swiss-sanctioned élite looting.”

Source: Tax Justice Network, 2015 Financial Secrecy Index

Problems with the USA and the United Kingdom

Surprisingly enough, the USA moved up three spots in this year’s rankings, making it to the podium and receiving a bronze medal for its secretive financial system and lack of reciprocity.

According to the Tax Justice Network, despite the US confronting American tax evaders head-on via the implementation of FATCA and likeminded regulations, it fails when it comes to providing other jurisdictions with information on their citizens’ accounts in the US.

About the US the organization says, “It is more of a cause for concern than any other individual country – because of both the size of its offshore sector, and also its rather recalcitrant attitude to international co-operation and reform.”

John Christensen, Tax Justice Network’s Executive Director, adds, “The United States dealt global financial secrecy a devastating blow by forcing strongholds such as Switzerland to open up. But after this blistering start in efforts to protect itself, it is backsliding by failing to provide information in the other direction: refusing to participate directly in global transparency initiatives such as the multilateral automatic information exchange and, inexcusably, lobbying to block public country by country corporate reporting. The USA must finally overcome its historically rooted opposition to reasonable tax data sharing with its trade and investment partners.”

The United Kingdom does not fare much better.

In fact, if the Financial Secrecy Index combined the UK with its Overseas Territories or Crown Dependencies such as the Cayman Islands, British Virgin Islands and Bermuda, it would go home with a shiny gold medal.

Even though the British government has pushed automatic exchange of information onto its territories, it “has failed to force them to create public registries of beneficial ownership, despite having the power to do so.”

Singapore and Hong Kong — No Interest in Common Reporting Standard

Both Hong Kong and Singapore earn high rankings as a result of their dislike for CRS and any sort of exchange of information.

Hong Kong, for instance, “hasn’t signed the multilateral agreement to initiate automatic information exchange via the CRS; it has a problematic record on corporate transparency; and unlike European countries it appears to have little appetite for country-by-country reporting or for creating registers of beneficial ownership.”

Luxembourg: Light at the End of the Tunnel?

Luxembourg, referred to as “Death Star of financial secrecy inside Europe” by the organization, improved its ranking in 2015, dropping four spots to number six.

What explains this improvement?

Tax Justice Network says it’s a combination of “the evolving international climate on transparency…with high-profile global scandals that have cast the tax haven in a highly negative light. These changes also coincide with the departure of Prime Minister Jean-Claude Juncker, arguably the most important architect of the secretive modern tax haven. “

Question: What are your thoughts on your jurisdiction’s ranking?

Question: What are your thoughts on your jurisdiction’s ranking?